The covid-19 pandemic has turned many economies into recession, the duration and depth of which is unknown and still debated. Initially a V shape recovery was the popular narration among economists. By mid April, when this analysis is written, a U shape impact gains the consensus, with the adverse L type scenario being described as less likely.

Most countries have taken multiple tiered measures to relief their citizens from the sudden and sharp fall of economic activity. Among them was the implementation of a moratorium of payments on loans held by individuals and businesses.

European Banking Authority, at their merit, demonstrated quick reflexes, by issuing statement and then guidance on default recognition eligibility and specifications over Significant Increase in Credit Risk (SICR) in case of payments moratorium.

The payments moratorium, however, will affect all the components of the Expected Credit Loss function in a variety of ways.

PD and Lifetime PD estimates

Most PD and Lifetime PD (LPD) retail estimates are based on Behaviour Scores or behaviour related attributes. In case of a business as usual classification of exposures continues during moratorium, the following dynamics are expected:

- Delinquency Bucket based predictors will demonstrate an artificially improved picture, i.e. with no delays in the behaviour period

- Payment counters / balance change related predictors on the other side will suggest an increase in risk levels

Given that bucket-based criteria are usually the predominant drivers in risk classifications, the overall expectation would be a concentration of the exposures (due to their characteristics becoming static) and a shift towards best PD pools (due to the higher importance of bucket related predictors). The higher the participation rate in the moratorium, the more intense these dynamics are expected to be as is presented in the following visualisation. In fact, these effects are expected to continue in the first months following the end of moratorium, until payment behaviour history is restored.

Beyond doubt, those patterns are not representing the true status of the portfolio. The overall risk level of the portfolio is not reducing, the classification is misleading and relationship between PD Pools and PD is not yet known.

Though each situation may be different, the general objective is to perform a classification considering the credit risk profile of the client and the level of exposure to the risks of the current economic environment in mid-term period, i.e. when the moratorium is expected to end. This could be achieved by combining

- A frozen version of the PD pools (or Behaviour Scores) before the impact of covid-19, which would represent credit risk profile

- With the forecasted impact of covid-19 by sector/type of activity

This approach introduces a forward looking aspect in the PD estimates and may have various levels of complexity, i.e. in the way the combination takes place (score level, overlay etc.), in the level of judgmental decision and use of any relevant historical data, fresh data as become available or by generalizing relations identified in economic sectors in other countries.

LGD estimates

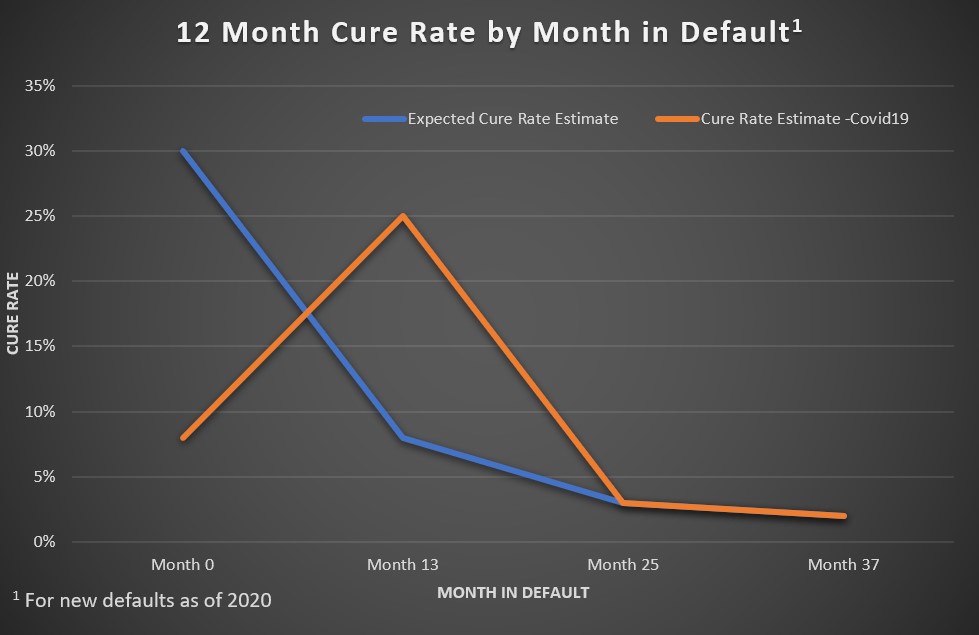

The Cure Rate component of the Loss Given Default (LGD) estimates is where the main interest needs to be placed, as is more sensitive to economic conditions while most remedial strategies are focusing in increasing cure rates.

Cure Rates are expected to be impacted in the following matters:

- Exposures being in default for less than 12 months (new defaults), for which usually a higher cure rate is expected, will be affected the most. For these exposures, the ability to make payments and become current is greatly impaired by the distressed economic conditions. Thus, the 12-month cure rate should be readjusted downwards. If a macro layer exists for this component, it could be employed considering the macroeconomic projections for GDP and other macroeconomic variables. If not, stressing the estimate is recommended. However, depending on the shape of the economic recovery, cure rates of the subsequent period may be significantly higher than any past observation. As such pattern may not be available in any training data for producing the estimate, Cure Rate in 2021 for months in default 13-24 may exceed any pre-existing macro-based model estimate.

- For exposures currently 13 months or more in default, expected cure rates should as well be downward adjusted, while expectations of cure rate bouncing in 2021 (i.e. at 25+ month in default by then) are low.

- Exposures not in default (stage 1 and 2) may be classified in two categories:

- For exposures eligible or in the moratorium, any default event will occur after the moratorium (with the exception of unlikeliness to pay (UTP) triggered default). The macroeconomic projections for this period (2021) are in most cases favorable. To a degree, Cure estimates as the existing or similar may be close to reality.

- For exposures not eligible for moratorium, the expected pattern should be similar to the already defaulted exposures (orange line in the previous chart), in case of default.

- Regarding expected recoveries from properties realization, property indexes should be adjusted according to scenarios on recession type that will impact the economy.

- Cash recoveries usually refer to a longer-term recovery period so less impact is expected

- It also worth noticing the need for extension of probation for already forborne exposures eligible for moratorium.

EAD estimates

Exposure at Default (EAD) estimates are expected to be impacted only mildly by the covid-19 and moratorium measures. Main dynamics that can be expected are:

- For fixed term exposures, the prolongation of the term with capitalization of interest should be considered in the estimated EAD in the term structure.

- For revolving, as long as limit monitoring, cash advances and authorizations tracking are in place, no impact is expected. It worth noticing though that in recession periods, inactive revolving facilities may become activated, with high default rates and high limit usages.

Conclusion

The first step for responding to the new reality that covid-19 introduced and the economic recession expected for 2020 is to understand and predict how the portfolios will be affected. Only then can decisions be informed, and appropriate actions can be taken so as to manage portfolios through these difficult circumstances.Towards this direction, adjustments or calibration of the ECL components estimates will be required, probably along with a further level of granularity that will better depict expectations for a different size effect on particular segments.