Scorecards’ and Rating Models’ regular validation is vital for the optimal function of the decision tools. The operating environment of the models is not stable. Changes may come from various factors such as systems, policies and processes, customers’ profiles, behaviour patterns, economic environment, competition, marketing initiatives, etc. Thus, regular Scorecards’ validation is imperative in order to identify any shifts in the models’ performance and decide on potential actions.

One of the side-effects of the 2008 Financial Crisis was the increasing interest by Supervisory bodies on the models’ Development and Validations practices followed by Banks, for which directives, guidelines and consulting papers are routinely being issued since. The use of models for Provisioning purposes, as part of the adoption of the IFRS 9 Standard, further increased the importance of a regular and holistic Validation process for those models.

Furthermore, independency on the Validation Function has now become a prerequisite, along with the the establishment of multiple and independent Validation levels: Validation by the (internal) Validation Unit, by the internal Audit Unit, by third parties.

Why StatDec?

StatDec Scorecards’ and Rating Models’ Validation Services are customized to the model type and use of the Model. They include statistical tests and performance metrics commonly used in the industry, while more advanced statistical approaches are employed where needed. Furthermore, the Validation Framework may be customized to the Client’s specific requirements, such as existing validation framework, specific tests and support in coding for internal monitoring.

StatDec Validation Services are not just an array of statistical tests. Though usually emphasis is placed on the statistical side, we introduce in the validation process a business perspective by aiming to answer on questions such as:

- Is the model being used properly?

- Is the model discriminating risk?

- Are the decisions optimal?

- Are the risk estimates by score accurate?

- Are the estimates on client’s profile accurate?

- What are the next steps?

The aim is to provide knowledge and insights on the functions of the Validated Models but also on what is happening on the Portfolios themselves.

The validation tests are conducted as separate blocks.

| Qualitative | Quantitative |

|---|---|

| Score Inputs & Data Processing | Discrimination Power |

| Data Quality & possible limitations | Accuracy |

| Model implementation accuracy | Distribution Stability |

| Exclusion Analysis | Concentration Analysis |

| Definitions review | Model Inputs Analysis |

| Model Use | Model Use |

When examined as a whole, one can understand what is happening in the Portfolio.

Findings on systems, policies, marketing activities and collections can be identified and presented as part of the Scorecard Validation. In many occasions, focused analysis will take place based on findings throughout the analysis so as to track the mechanisms and reasons behind the observed patterns.

Results are intuitively benchmarked to expectations, as set on the specific portfolio but also making use of market experience on similar portfolios.

Validations are accompanied with a proposed customized action plan based on the findings of the analysis. Best practices are recommended, that are not necessarily restricted to Models’ changes.

The use of StatDec Validation Services allows for an expert and in-depth validation of an organization’s Model inventory. In situations that an independent validation or an additional validation layer is required, StatDec can support Businesses with professionalism and deliverables of the highest quality.

Unlock the power of data with propensity models, for more informed decision-making!

Propensity models can forecast customer behavior, enabling you to make data-driven marketing, sales, and product development.

Propensity models are statistical models that predict the likelihood of a customer taking a certain action, such as making a purchase, responding positively to a campaign or churning. These models can be used to improve business performance in a number of ways, including:

- Acquiring new customers: By identifying customers who are more likely to convert, businesses can focus their marketing efforts on the right people.

- Retaining existing customers: By understanding what factors lead customers to churn and turn to competitors, businesses can take steps to reduce churn rates (attrition or churn models)

- Cross-selling and upselling: Propensity models can be used to identify customers who are likely to be interested in additional products or services (conversion models)

- Customer segmentation: Propensity models can be used to segment customers into groups based on their likelihood of taking certain actions. This information can be used to create targeted marketing campaigns.

- Personalizing the customer experience: By using propensity models to segment customers, businesses can create more tailored and relevant offers and promotions.

- Risk assessment: Propensity models can be also used as inputs to risk scores (e.g. credit risk, etc.).

- Cost Efficiency: Maximize your marketing budget by targeting only those prospects with a high likelihood of responding positively. This leads to cost savings and a more efficient allocation of resources.

- Competitive Advantage: Stay ahead of the competition by leveraging data-driven insights that your rivals may not be utilizing to the same extent.

Our approach is a unique blend of advanced analytics, machine learning, and deep expertise in implementable solutions, tailored to your specific needs, as it includes:

- Methodology design based on review of requirements, processes, data definition, data availability and implementation environment.

- Data review, management and preparation

- Creation of quality definition and development sample

- Examine all the potential variables that will be considered under the development process (systemic variables and derived/transformed ones, dynamic vs. static, etc.)

- Model development (use of Machine Learning algorithms or more conventional approaches)

- Model validation in independent sample – as part of the development (if possible)

- Full Documentation on model development, including probability tables (strategy tables)

- Support in model implementation

With StatDec’s propensity models, you will improve your customer targeting, and be able to optimize your marketing and sales strategies.

The need for evaluation of a retail portfolio usually occurs when a portfolio is to change ownership.

Typical such engagements take place in cases of merges & acquisitions and when a portfolio or a segment of it is in selling process (debt sell).

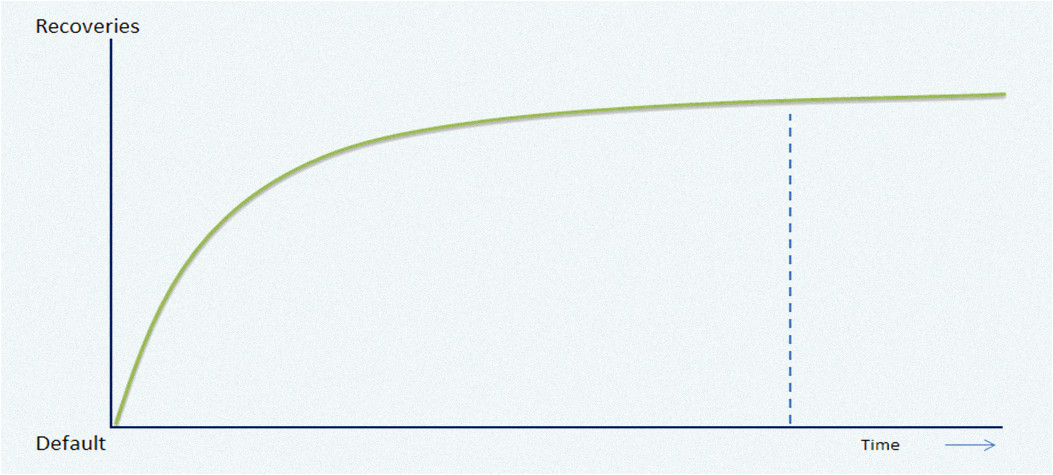

Participants in this process require a fair and accurate estimation of future cashflows of the portfolio so as to estimate it's present value and set a price.

Statistical Decisions approach in estimation is based on long experience in analyzing behavioir patterns in retail portfolios and consists of the following elements:

- Data quality and process review for deciding on whether data represent full and concise information for the analysis

- Identification of key drivers for future cashflows or recoveries

- Benhmakring vs reference expectations

- Model or segmentation approach for portfolio cashflows estimation for lifetime of fixed time horizon

Scoring models and analytics are widely used by telecommunication (Telco), Internet and Energy providers for an efficient management of their client base and support expansion to new client segments.

Models are built to answer specific questions of the organization, such as what is the probability of a client to leave (churn models), will a client pay the bill, propensity of customer reaction to an event, etc.

Furthermore, MIS design allows to track business KPI, adjust to market events and make better use of the data already available in the organization.

Models for Energy and Telco providers usually cover the following topics:

- Risk & Default

- Attrition or Churn Probabilities

- Response , Cross-Sell, Renewal

- Profitability and Lifetime Value

- Utilization of Limit

- Fraud

- Propensity (customer reaction to an action)

Why StatDec?

With 30 years of experience in developing and supporting predictive models, StatDec is a reliable and experienced partner that can support Telco and Energy providers to make knowledge out of their data and implement data-driven decision models and strategies.

Usual benefits from StatDec's analytic services in Telco and Energy providers may fall in the following categories:

- Ability to Automate & Standardize Actions

- Targeted Customer Approach

- Cost Reduction

- Pro-active Strategies

- Allowance for Champion : Challenger business culture

- Measurable Results

- Closer portfolio monitoring and data management

- Collections efficiency

When a Financial Institution wishes to initiate new or ad-hoc analysis, Statistical Decisions can provide our practical experience and advanced technical skills in the design and implementation of the project.

Initiatives such as Profitability Modeling and Risk Based Pricing as well as the urgent or occasional need for specific analyses in projects such as Stress testing or Securitization Support are typical undertakings.