Commitment & Responsibility – We take ownership of our assignments and we are committed to provide superior services to our clients.

Quality – We believe in our work and we place our outmost care on each project.

Integrity – Proud for our strong business ethics and integrity.

Respect – Statdec’s working culture is in its core based on respect; towards and from our clients and associates, but also between staff members

A Tailored Solution – No two institutions or sets of circumstances are the same; In StatDec we do not offer off-the-shelf solutions but instead approach each project as a unique challenge and delivers targeted solutions set at the correct level for each situation.

Full Consultation – Success in retail banking involves the interaction of many processes and areas of the business. With our in-depth knowledge and extensive experience of the whole cycle, we are able to advise our clients on the impact of changes not only in the area being examined but also the knock-on effects on other areas of the business.

Not content with just reporting numbers; all of our reports, analysis and other outputs are reviewed by more than one experienced professionals who add targeted consultation and actionable recommendations

Full Disclosure – StatDec abhors the black-box approach offered by many in the industry. In order for a business to progress it is essential that their staff becomes familiar with the rationale, functioning and impact of all parts of the credit cycle. To this end, knowledge transfer is an inherent and fundamental part of every StatDec’s project.

Collaboration – is the key to the success of a project with both parties, StatDec team and the client, working closely together, building trust and each providing important insights; StatDec will bring the same high degree of commitment to every project

IT-Independent Solutions that allow flexibility in implementation alternatives and avoid compatibility constraints

Flexible and Responsive Project Management, so as to link deliverables with findings throughout the analysis

StatDec provides Independent Portfolio Valuation services for Buyers or Sellers of Retail Portfolios.

Whether as a part of merger and acquisition due diligence, the sale/purchase of distressed assets or preparation for the secondary market, it is essential to be able to quantify future cash-flows from both anticipated income, likely credit losses and, especially in the case of distressed portfolios, recovery streams.

Determination of the expected future revenue of a portfolio allows appropriate pricing for asset sales.

Using StatDec’s broad experience in analysing retail portfolio behaviour, the methodology that best fits the given situation is selected.

Approaches taken include:

- Data quality and process review to confirm that the available data represent full and concise information for the analysis

- Identification of key drivers of future cash-flows or recoveries

- Benchmarking expectations vs. reference portfolios

- Model and/or segmentation approach for portfolio cash-flows estimation for lifetime or fixed time horizon

Why StatDec?

StatDec's Valuation Solutions offer a trustworthy and independent assessment of a portfolio value, from a firm renowned for its experience and technical expertise in Retail Credit Risk modelling.

StatDec's Portfolio Valuation solutions can be based on both Bottom-Up and Top-Down approaches, depending on the information depth and the objective on the accuracy of the estimate. Bottom-up approaches require more extensive data management but provide better estimations, since they capture the portfolio dynamics based on risk criteria in greater detail. Recovery and PD models are used or developed for the purposes of the Valuations, while results can be macroeconomically adjusted to represent scenarios on future economic conditions

In Countries with extensive market experience of retail portfolios Behaviour patterns, such as in the Greek and Romanian, StatDec's Valuations can be benchmarked against relevant portfolios. Thus, Portfolio Valuations can be enriched with expert judgement even in situations with data limitations.

Management

The management team of StatDec is formed by professionals with extensive experience in modelling and consulting in retail portfolios.

Dimitris Velopetropoulos, Risk Manager

Christos Grammatikos, Risk Manager

Malcolm Rhoades, Management Consultant

Staff

StatDec's analytics and consulting staff has a strong educational background with postgraduate degrees in fields of mathematics, statistics, operational research and decision sciences.

Training and self-improvement is part of StatDec's business ethics.

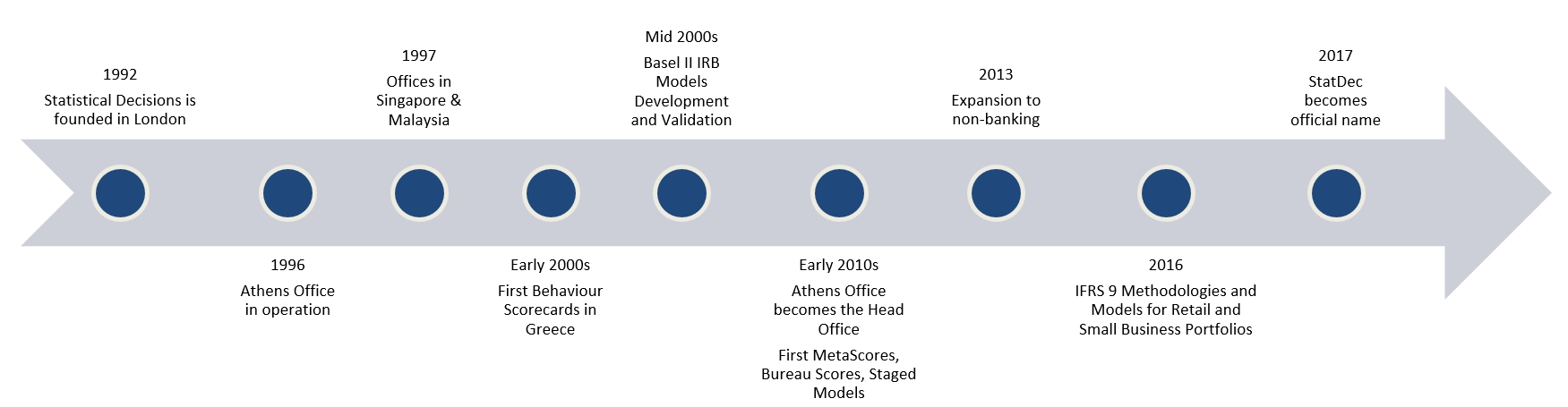

Statistical Decisions was formed in London in 1992.

Its founding partners were staff of Citibank's EMEA Group Credit Office.

The Statistical Decisions Partnership aimed to demonstrate the true effectiveness of Credit Scoring and Data Driven Decisions for managing Retail Portfolios.

Early 1990s were a turbulent period for Banking, as many economies suffered from recession. Mechanical data-driven approaches in the Financial Sector were challenged and calls were made to abandon Credit Scoring.

Yet, the expansion of Retail Banking, the further sophistication in modelling practices and advancements in IT capabilities along with the wide increase of computing power made Credit Scoring as best practice for managing big portfolios.

In the 2000s Statistical Decisions was established as a leading practitioner of Credit Scoring techniques, advancing the efficiency of markets served with tools for optimized, data-driven decision-making processes

In the mid-2000s the new regulatory frameworks on Capital Requirement (Basel II) set Credit Scoring at the centre of managing and estimating Credit Risk for Retail portfolios. Statistical Decisions’ Credit Score development techniques and documentation were directly acknowledged as compliant, exceeding supervisory requirements.

By 2010s, the Athens office, established in 1996, became the main modelling hub of the company, advancing the local and regional market knowledge on Credit Scorecard development and use, Retail Banking best practices and setting up a reference point for professionalism and service.

In 2016, the IFRS 9 Standard on Provisions introduced the requirement of using ‘best estimates’ in calculating provisions, i.e. a probabilistic approach. Again, Credit Scorecards were considered the optimal tool for risk classification and deriving best estimates of default rates. StatDec, with long experience in developing and maintaining Credit Scores, supported Financial Institutions to use Credit Scorecards, along with other Model types, in this area as well.

In 2017, with respect to its heritage, the company adopted the name many of the clients and staff unofficially used, and Statistical Decisions was naturally renamed to StatDec. The official name is still occasionally used.

In 2017, with respect to its heritage, the company adopted the name many of the clients and staff unofficially used, and Statistical Decisions was naturally renamed to StatDec. The official name is still occasionally used.

By the 2020s the availability and use of data in making decisions and managing portfolios had expanded beyond banking, into retail merchants, energy providers, telecommunications and other sectors. With over 30 years of experience in processing massive datasets and developing models, StatDec brings this expertise to new areas and supports businesses in making informed decisions based on state-of-the-art modelling techniques such as Machine Learning Models for Transactional and Behavioural Models.